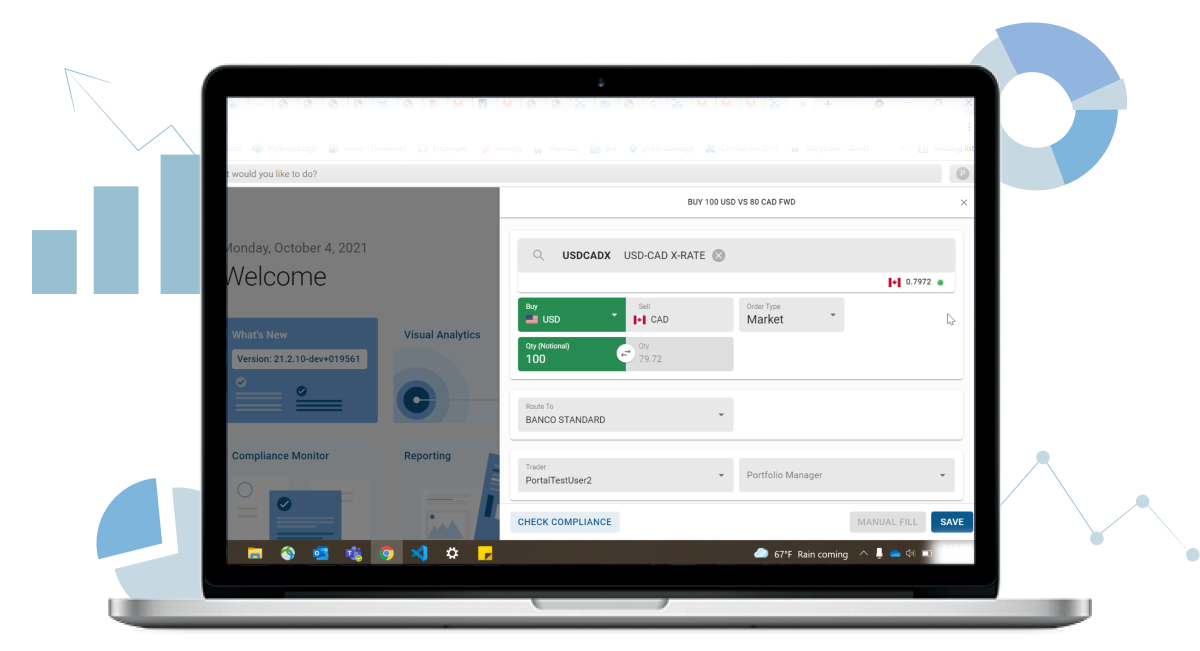

Snapshot

What is the FX Order?

FX Order is a sophisticated trading platform designed for institutional clients and professional traders in the foreign exchange market. It offers an innovative and comprehensive solution tailored to meet the needs of FX trading professionals, ensuring efficiency, security, and compliance in their trading operations.

My Contribution:

I collaborated with UX/UI designers to create an intuitive interface, optimized the platform for various devices, implemented real-time data visualization tools, and developed a user-friendly order management system. Additionally, I ensured accessibility compliance, cross-browser compatibility, and conducted thorough testing to enhance performance and functionality.

Role:

Front-end development

Duration:

Jan’21 - Oct'21

S/W Used:

HTML/CSS, React, Confluence, Jira, Figma, Zoom, Teams

Case Study Outline

Project Overview

01Agile Workflow for Development

02In an Agile environment, the frontend team for the FX trading platform project followed a dynamic and structured workflow:

-

Daily Stand-ups

Discussed progress, addressed roadblocks, and planned daily tasks.

-

Sprint Planning

Prioritized and aligned tasks for each sprint to ensure focus on key deliverables.

-

Implementation

Developed user stories in collaboration with UX/UI designers and backend developers while adhering to coding standards.

-

Continuous Integration and Testing

Maintained code quality and promptly identified issues through automated and manual testing.

-

Collaboration

Fostered open communication with regular feedback loops across design, development, and backend teams.

-

Peer Reviews

Conducted code reviews to ensure quality and share knowledge within the team.

-

Sprint Demos and Retrospectives

Reflected on progress, gathered feedback, and identified areas for continuous improvement.

This iterative and collaborative approach ensured efficient development and alignment with project goals.

Understanding the User

03Target Audience

-

Traders

Currency trading professionals, including day traders, swing traders, and algorithmic traders.

-

Portfolio Managers

Investment experts managing portfolios with currency exposure.

-

Compliance Officers

Specialists ensuring adherence to industry regulations and trading best practices.

-

Operations Officers

Professionals overseeing trading operations, risk management, and trade settlement.

-

Investors

Individuals and institutions trading currencies for diversification, speculation, or hedging purposes.

User Responsibilities

-

Monitoring Market Conditions

Tracking real-time data, currency trends, and economic indicators for informed decisions.

-

Placing Orders

Executing accurate buy/sell orders based on market analysis.

-

Managing Positions

Adjusting open positions, setting stop-losses, and closing trades when necessary.

-

Analyzing Performance

Reviewing trading strategies, evaluating past trades, and identifying areas for improvement.

User Frustrations

-

Complex Interfaces

Difficulty navigating overly complicated platforms, causing inefficiencies and errors.

-

Limited Data Access

Challenges in obtaining real-time or historical data to inform trading decisions.

-

Order Execution Delays

Missed opportunities or losses due to slow or failed execution.

-

Lack of Support

Insufficient or delayed technical support when encountering issues.

User Motivations

-

Profit Potential

Maximizing returns by capitalizing on market trends and fluctuations.

-

Skill Development

Enhancing knowledge and expertise in FX trading through experience and resources.

-

Financial Independence

Achieving personal financial goals through consistent trading success.

-

Professional Growth

Advancing careers by refining trading skills and building a solid track record.

This user understanding informed the platform's design and functionality, ensuring it addressed user frustrations and supported their goals effectively.

FX Order Feature Workflow: Steps and Significance

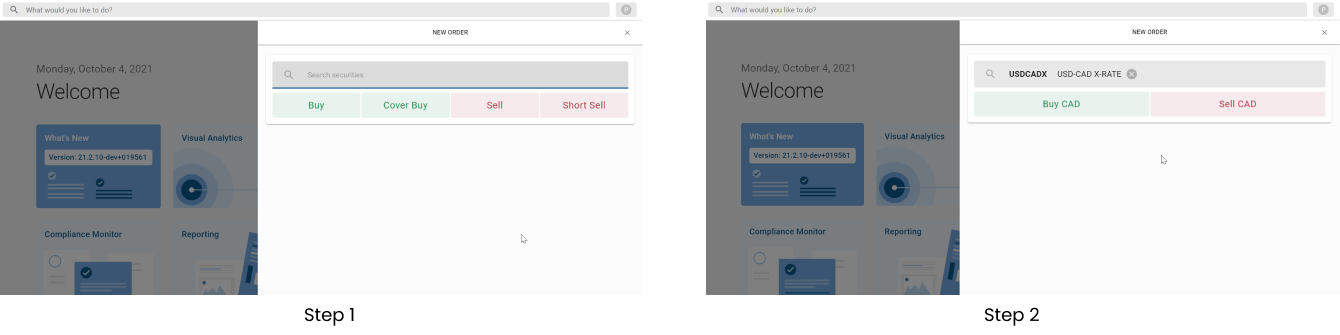

04Step 1 & 2

After logging into the portal, click the "New Order" button to access the order creation screen. Here, you'll find options to choose from "Buy," "Cover Buy," "Sell," or "Short Sell." Select the appropriate action based on the currency of the securities you wish to trade, using the search function if needed to streamline your selection.

Step 3

-

Trade Direction

Users indicate whether they want to buy or sell the selected currency pair. This is typically done by clicking on buttons labeled "Buy" or "Sell."

-

Currency Pair Selection

Users can choose the currency pair they want to trade, such as EUR/USD, GBP/JPY, or USD/JPY. This selection is made from a dropdown menu or by typing in the desired currency pair.

-

Order Type Selection

Users can specify the type of order they want to place, such as a market order, limit order, stop order, or other advanced order types. Each order type has different parameters and execution conditions.

-

Order Quantity

Users can specify the quantity or volume of the currency they want to buy or sell. This is entered as a numerical value in a designated input field.

-

Forward Limits

Forward limits allow users to set predefined parameters for forward contracts, specifying the maximum or minimum exchange rate at which they are willing to execute a trade for a future date. This feature provides users with greater control over their trading strategy and helps mitigate potential risks associated with adverse exchange rate movements.

-

Value Date Selection

Users can select the value date for their FX orders, specifying the date on which the currency exchange will occur. This feature is particularly useful for users engaging in forward contracts or other types of derivative transactions, allowing them to align the trade execution with their specific liquidity needs or market expectations.

-

Forward Points

Forward points, often expressed in basis points (bps), represent the interest rate differential between two currencies for a specified period. Users can leverage forward points to calculate the cost or premium associated with entering into a forward contract, providing valuable insight into the relative value of different currency pairs and maturities.

-

FX Order Security

FX order security measures are implemented to safeguard users' trading activity and sensitive information. This may include encryption protocols, secure authentication mechanisms, and real-time monitoring of trading activity to detect and prevent unauthorized access or fraudulent behavior.

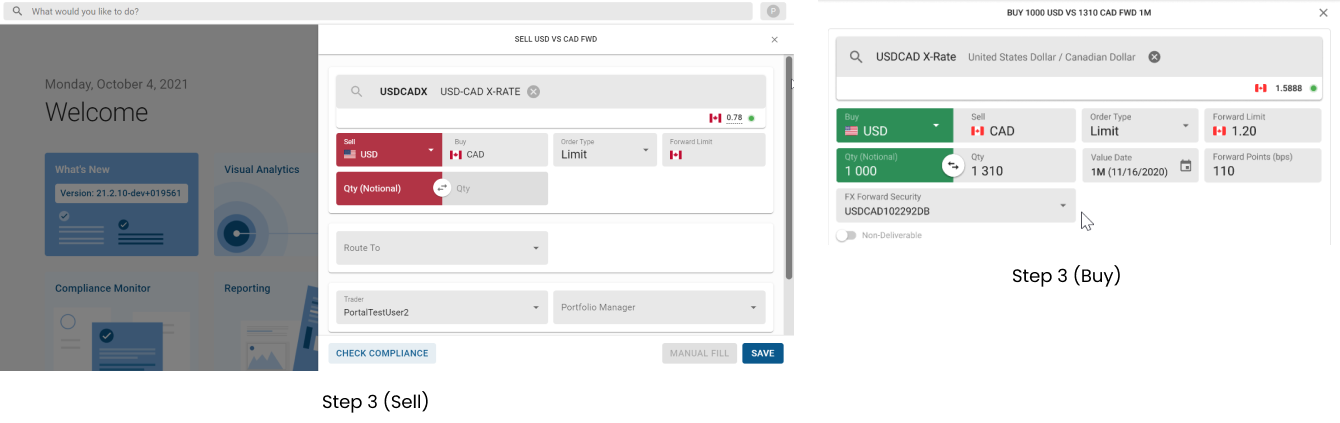

Step 4 & 5

-

Route To Functionality

The route to function allows users, such as traders and portfolio managers, to specify the destination or counterparties for their FX orders. This feature is particularly beneficial for institutional investors or corporate clients who may have specific execution requirements or preferential relationships with certain liquidity providers or counterparties.

-

Trader Access

Traders, responsible for executing trades on behalf of clients or managing proprietary trading portfolios, rely on the FX order screen to access real-time market data, execute trades efficiently, and manage order flow effectively. The platform provides traders with intuitive order entry tools, customizable order types, and advanced execution algorithms to streamline the trading process and maximize execution quality.

-

Portfolio Manager Oversight

Portfolio managers oversee the trading activities and currency exposure of investment portfolios, ensuring alignment with investment objectives, risk constraints, and regulatory requirements. The FX order screen offers portfolio managers visibility into order flow, trade execution, and currency positions, empowering them to monitor portfolio performance, rebalance exposures, and implement hedging strategies effectively.

-

Compliance Checks

The FX order screen incorporates automatic and manual compliance checks to ensure that trades adhere to regulatory requirements, internal policies, and client mandates. Automatic compliance checks utilize pre-defined rules and parameters to validate orders in real-time, flagging any deviations or violations for further review. Compliance officers can conduct manual checks as needed, verifying trade details, assessing risk implications, and approving or rejecting orders accordingly. This dual-layered approach to compliance ensures that FX orders are executed in accordance with legal and regulatory standards, mitigating compliance risks and safeguarding the integrity of the trading platform.

-

Non-Deliverable Forwards (NDFs)

NDFs are derivative contracts settled in a reference currency, typically USD, where the difference between the contracted exchange rate and the prevailing market rate at maturity is settled in cash. The FX order screen facilitates the execution of NDF trades, allowing users to hedge currency risk or speculate on exchange rate movements in markets where physical delivery of currency is restricted or impractical.